For some Americans, going out to dinner or buying that new gadget, is planned and budgeted for. For others, it's just another day.

When it comes to planning for later in life the second unprepared group is growing at an alarming rate.

And when it comes to dealing with current debt for many Americans this is a daunting task. From increasing payment amounts to declining credit scores which limit options for paying debt off a lot of us just decide to ignore the issue and live for today. Many have trouble starting new things or making changes to current lifestyle so they dont deal with budgeting. as in this case:

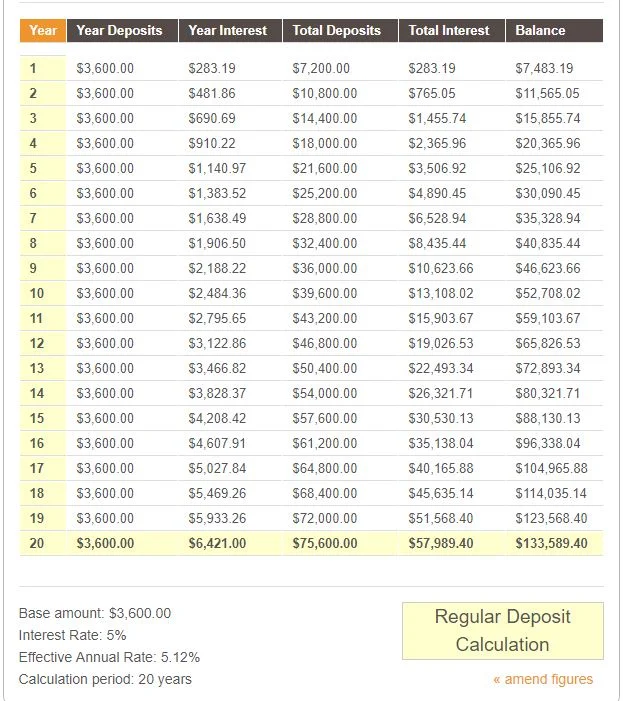

The average household spends an average of $3,008 per year on dining out, the Bureau of Labor Statistics reports. A $15 lunch is $3600 a year. $3600/yr over the next 20 years at an average 5% return would yield you $133589 and thats without yearly inflation increase of your savings.

Surviving in non ideal situations (ie. tons of debt) through budgeting will help you thrive when those situations become ideal.

For those with the means to spend an exorbitant amount on food, clothing, gadgets, vehicles this epidemic might not register as an issue. Average Americans can't affordcostly habits especially at the expense of being unprepared for an emergency, or, worse, having to work past retirement age.